Financial Clarity Customized to You

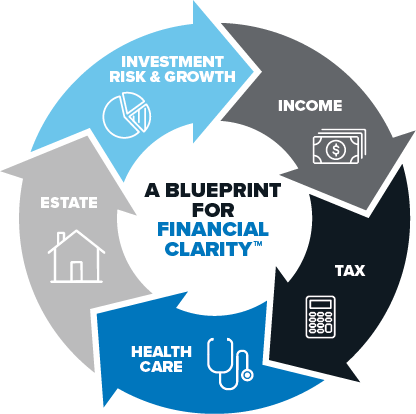

We created our signature five-step Blueprint for Financial Clarity™ to provide a foundation for your customized, long-term strategy. We listen to you to understand your unique priorities because holistic financial planning isn’t a one-size-fits-all approach, but rather an ever-evolving process to help you:

Track your individualized goals

Live the lifestyle you want

Prepare for the unexpected

Create retirement confidence

Whether your concern is paying too much in taxes, exposing yourself to too much risk, not having sufficient income, or tackling health care and estate planning, we can help.

Lundervold Financial does not provide tax or estate planning, but we become a part of our clients’ estate planning team. If you are looking for an estate planner or tax professional, we can refer you to one of our partners who provide the following services: trusts, probate, charitable giving, estate planning and tax planning.

We Offer the Following Services and Products:

- Investment Advisory

- Rollovers and Transfers

- Individual Retirement Accounts (IRAs) and Roth IRAs

- Major Life Events (Marriage, Kids, Divorce, College, Retirement, Loss of a Loved One)

- Annuities and Lifetime Income Strategies

- Social Security Planning

Lundervold Financial does not provide tax or estate planning, but we become a part of our clients’ estate planning team. If you are looking for an estate planner or tax professional, we can refer you to one of our partners who provide the following services: trusts, probate, charitable giving, estate planning and tax planning.

Your Questions Are Important. Who's Answering Them?

What financial issues are keeping you up at night? If you are like many we’ve helped through the years, we suspect it’s questions like these.

Contact the team at Lundervold Financial today to begin finding the answers and retirement confidence you deserve.

- Will I be able to retire early?

- How much money will I need to retire?

- How can I get the most out of my 401(k)?

- Should I have a traditional IRA or a Roth IRA?

- How can I position my investments for higher potential returns while reducing risk?

- How can I "inflation-proof" my investment income?

- Do I need disability income insurance? Long-term care insurance?

- How can I ensure that my children receive as much as possible from my estate?

- What do I need to know about wills, trusts and probate?

- Will I be able to retire early?

- How much money will I need to retire?

- How can I get the most out of my 401(k)?

- Should I have a traditional IRA or a Roth IRA?

- How can I position my investments for higher potential returns while reducing risk?

- How can I "inflation-proof" my investment income?

- Do I need disability income insurance? Long-term care insurance?

- How can I ensure that my children receive as much as possible from my estate?

- What do I need to know about wills, trusts and probate?